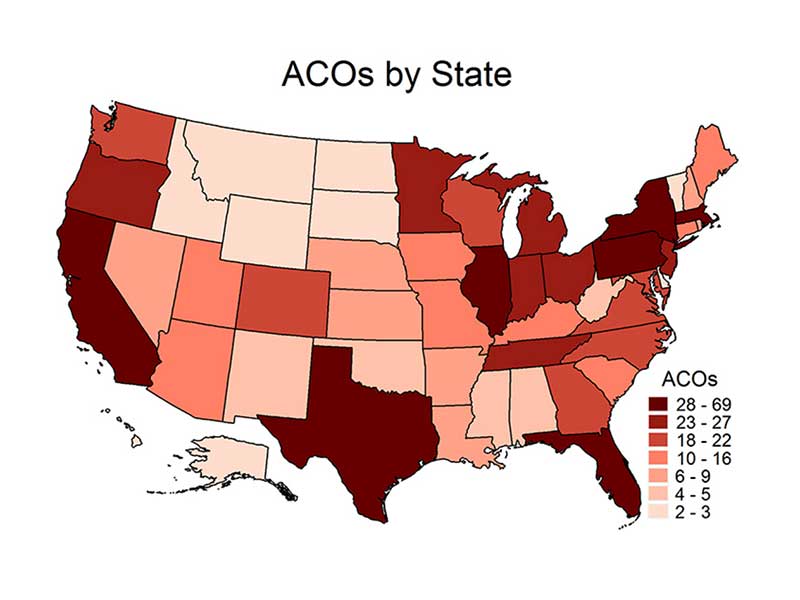

Elliott Fisher first described the concept of the ACO in an article in Health Affairs in December 2006. As of January 2016 there were over 800 ACOs, but there is huge variation in form and execution of an idea that looked simple at the start. Since 2011 the number of people getting their care from a CMS, Medicaid or Commercial ACO has grown from zero to over 28 million. That means that close to 10% of Americans get their care from an organization that they may not understand. Most healthcare professionals do not completely understand what ACOs are and the changes in practice necessary for ACO success. The current level of confusion actually represents improvement because before 2011 a common joke among healthcare policy wonks was that ACOs were like unicorns: everyone had heard about ACOs, but no one had ever seen one.

Given the current imperfect state of understanding about ACOs, their variation and the recent publication of the shocking news that Dartmouth, the home institution of Fisher is withdrawing from Medicare ACOs, it may be informative to go back to Fisher’s original article as we try to think about what has happened to the idea over the past ten years. Here is the abstract from that original paper.

Many current policies and approaches to performance measurement and payment reform focus on individual providers; they risk reinforcing the fragmented care and lack of coordination experienced by patients with serious illness. In this paper we show that Medicare beneficiaries receive most of their care from relatively coherent local delivery systems comprising physicians and the hospitals where they work or admit their patients. Efforts to create accountable care organizations at this level—the extended hospital medical staff—deserve consideration as a potential means of improving the quality and lowering the cost of care.

I bolded the type that introduced the term “accountable care organizations”. Fisher acknowledges that he wished they could have thought of a better new for the idea, something with a little more pizazz to call the concept than “ACO”. I think that he was worried about introducing another acronym that would become a “four letter” word that would elicit the sort of negative emotions that “HMO” could engender from both patients and providers by the end of the nineties. If you clicked on the last link you could have read an analysis that quotes from a paper by Enthoven and Singer:

HMOs are not helpless victims of managed care backlash. Rather, at times, they seem to be their own worst enemies…. Some health plans have been insensitive and unresponsive to consumers and have treated employers instead as their primary customer…. Health plans should involve consumers in a process of continuous quality improvement…. Many plans have done a poor job of recognizing and responding to consumers’ and patients’ concerns by failing to provide innovative products with attributes that are desirable to consumers.

Despite the anger they caused there are still hundreds of “HMOs”. Harvard Pilgrim Health Care was and still is one of the most virtuous and innovative providers of HMO products. When Harvard Vanguard was created out of Harvard Pilgrim in 1998 almost all its patients were in some form of an HMO contract. Ten years later in 2008, when I became CEO, fewer than 40% of our patients were in any type of HMO product with risk.

For Harvard Vanguard and Atrius Health the period between 2000 and 2008 was the reverse of today’s volume to value migration. Just as today organizations are scrambling to develop the skills of “population health” and the infrastructure to “accept risk based contracts”, we were scrambling to learn how to effectively generate FFS revenue. To my great sorrow, we dismantled much of our managed care infrastructure. The focus shifted from improving quality and lowering the total cost of care in favor of pursuing more encounters delivered with “enhanced fee schedules”. I have empathy for organizations that now claim that they are having a hard time understanding how to move from volume to value. I also know that just as we did what we needed to do to survive, if they really care about their practices and institutions, they will figure it out.

I first heard Elliott Fisher speak in 2007. Change was in the air. Massachusetts had passed Chapter 58 (Romneycare) in 2006. His ACO idea sounded a lot like HMO 2.0 to me and I was all for that. I saw HMOs as the imperfect first attempt to find the answer to Dr. Ebert’s request for a “conceptual framework and operating system that will provide optimally for the health needs of the population.”

I believed that HMOs had not failed, but rather, with the exception of a few like Harvard Pilgrim and Kaiser, the concept had been co opted by people interested in making a lot of money. We needed to examine what had gone wrong and produce Managed Care 2.0. Calling Managed Care 2.0 an ACO was a good idea since the term HMO was tainted. My short list of problems would include:

- The focus had shifted from the transformation of care delivery to finance. Berwick would call it greed.

- With the exception of organizations like HCHP and Kaiser, the model co opted and undermined by IPAs and all sorts of other organizations that were focused on profits and not on improving care. They were willing to deny necessary care to be profitable.

- “Experience rating”, “sole sourcing care”, “cherry picking”, and other “externalities” in the market had created a difficult business environment.

- Patients and employers wanted “choice” over tightly managed systems and were willing to pay for it.

- We did not really have tools for continuous improvement or to understand our populations. Our competencies did not measure up to the challenge.

In the “what part of the problem are we” view of healthcare, we had contributed to the problem because our efforts to “capture market share”, “grow the network”, and satisfy the demands of purchasers for “choice” had diverted our attention from coordinating care, improving quality, and focusing on the infrastructure to manage disease and engage our patients with outreach that improved their health. We had lost our way. Instead of showing the world a better way, the status quo had taken our way, defiled it, and used it to their advantage.

I was ready for what Fisher was suggesting. With new tools like software programs to assess populations and new skills in continuous improvement like Lean, we would be enabled to better understand the various populations that composed our practice. We could do a better job of improving care while more effectively using our resources. Fisher was suggesting an operating system that was focused on collaboration and collective rewards and not on individual performance. Everything in his vision resonated with my own best experience.

In retrospect he was saying many of the same things that Don Berwick emphasized in his description of Era 3. Fisher connected the measurement and finance focus on individuals in the post HMO attempts of payment reform to the fragmentation of care. His breakthrough concept was accountability for group performance to improve care and lower the cost of care. I was thrilled.

In early 2008, when I assumed the role of CEO, Blue Cross was offering the Alternative Quality Contract (AQC) which encouraged a refocus on many of our managed care competencies that had withered as we developed our fee for service strategies. The stars seemed to be aligned. The AQC was like a dress rehearsal for being an ACO. I envisioned the whole organization as the ACO. “ACO” was a description of how we delivered care more than a description of how we got paid.

I am not discounting the importance of the coupling of the operating system and finance in healthcare. It is true that good care should be rewarded, but the proper order is performance first and payment second. HMOs became unpopular and failed because finance became more important than performance for the patient. For many ACOs finance has been the driver and care delivery is secondary. I believe that few organizations see the ACO concept as a description of what they are rather than one of many insurance products that provide their revenue.

Physicians and organizations that depend mostly on fee for service income often complain that the care they can deliver is limited by the services that can be attached to a billing code. ACOs accepting risk for their performance should be able to design care around what patients need rather than around the revenue that will be generated by a series of billing codes. To my surprise, as the ACO process moved forward, almost no one seemed to see their total organization as an ACO. Most saw their organization as having some percent of their population in ACO contracts. For most of them it was just another finance mechanism like their PPO products and residual HMO contracts. The term ACO did not really make them think of transforming care. It did not describe what they were or wanted to be. If they did have a focus on cost and quality, it was in some context of revenue from pay for performance schemes that were layered on top of business as usual. The patients who were in an “ACO” were just in another contract and a minority of the total practice.

When a practice still has most of its patients in contracts that are “volume based” FFS contracts it is hard to simultaneously care differently for a minority of patients who are in “value based” risk products. The problem is compounded by the fact that even in organizations that are receiving large amounts of “value based” revenue, their physicians are most commonly compensated for “volume performance” with perhaps a little bonus added like a cherry on top for “quality.”

For ACOs to fulfill the vision that Fisher’s idea promised, the process of change must move down to the individual level. We must negotiate best practices and processes of care within organizations. How we get paid as individuals must be aligned with how we are collectively compensated as practices and systems of care. Payment for accountable performance can only make sense when the organization thinks of all of its patients in terms of their accountability for quality, service and cost. Finance is secondary to the mission despite the universal misinterpretation of the famous quote by Sister Irene Kraus, “No margin, no mission.” The key is to focus on care improvement and not to make finance the sole driver of strategy.

Whether or not the ACA survives the election, I believe that the competencies of a successful ACO as envisioned by Fisher, and despite the financial decision made by Dartmouth, is the best strategy for the Triple Aim and

Care better than we’ve seen, health better than we’ve ever known, cost we can afford…for every person, every time.

MACRA was passed with bipartisan support. Even as Humana, United, Aetna, Anthem and other big insurers talk about exiting the exchanges they are expending great resources to develop ACO like payment mechanisms for the future. The benefits of the concepts described in the reformulation of Managed Care as ACOs will continue to evolve. The number of clinicians and organizations that embrace the changes that are inevitable can only grow. The politics of resistance to the inevitable need to bring healthcare costs into line while improving quality and extending care to everyone create a noise that should not detract thoughtful providers from doing what they need to do to improve. It is a very pragmatic process of testing ideas with experiments like ACOs and then taking what we learn as a basis for refinement and further advancement, and not as a reason to abandon the effort.